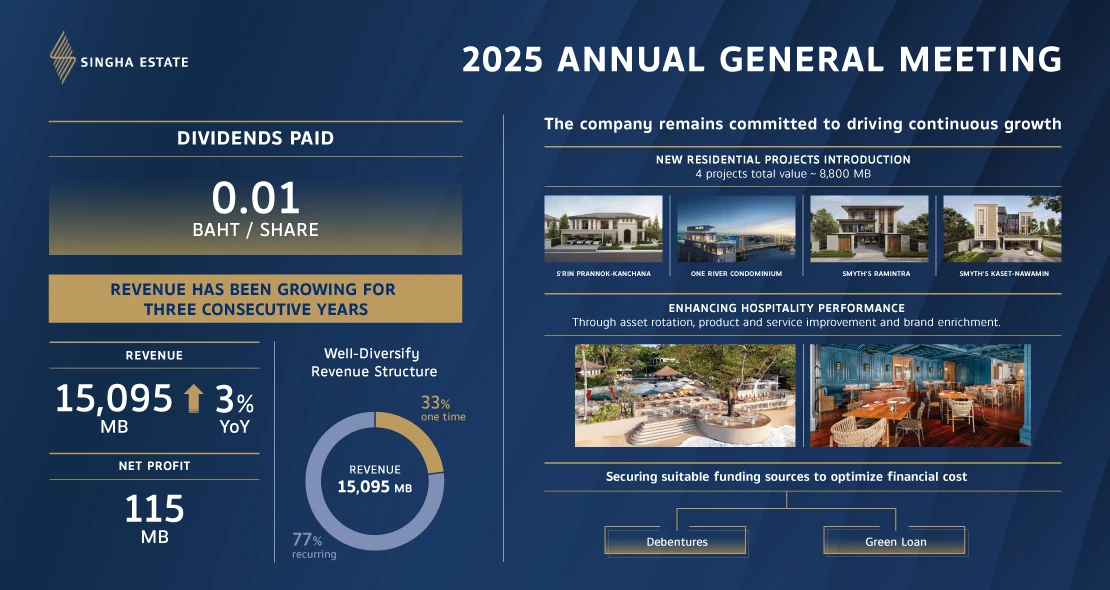

Singha Estate Public Company Limited (SET: S), led by Mr. Petipong Pungbun Na Ayudhya, Chairman of the Board, and Mrs. Thitima Rungkwansiriroj, Director and Chief Executive Officer, together with the Board of Directors, convened the 2025 Annual General Meeting of Shareholders to present Singha Estate’s 2024 performance and outline strategies for 2025. The shareholders’ meeting also approved the 2024 annual dividend payment of 0.01 Baht per share, representing a 94.54% dividend payout ratio of adjusted net profit. The dividend payment is scheduled for May 15, 2025.

Thitima Rungkwansiriroj, Director and Chief Executive Officer of Singha Estate Public Company Limited, revealed after the meeting that “Despite facing challenging market conditions in the previous year which resulted in a slowdown in certain business units, our well-diversified investment strategy across multiple ventures in 2024 enabled us to achieve steady revenue growth for three consecutive years. This performance has allowed the company to maintain consistent dividend payments to shareholders.”

For 2025, Singha Estate continues to prioritize cash flow stability along with sustainable growth in both recurring and non-recurring income streams. In the residential real estate segment, the company plans to introduce four new projects with a combined value exceeding 8.8 billion Baht across four strategic locations in Bangkok. These upcoming residential projects will complement nine existing operational projects in the luxury segment, valued at over 26,744 million Baht. Since all projects are comparatively less susceptible to economic fluctuations and banking sector lending constraints, Singha Estate is confident that revenue from the residential real estate business will continue its growth trajectory through 2025.

Meanwhile, the hotel business which constitutes the company’s primary source of recurring income is implementing strategic initiatives to strengthen the investment portfolio following the success of the previous year’s property improvements. For instance, SAii Laguna Phuket Hotel achieved a 36% increase in room rates compared to pre-renovation pricing. The strategy also includes divesting underperforming hotels to enhance overall investment returns while considering acquisitions in high-potential locations that align with contemporary tourism trends—thereby bolstering revenue growth and profitability in the hotel business segment.

For commercial real estate as well as industrial estate and utilities businesses, the strategy will emphasize targeted customer acquisition approaches to increase sales conversion rates at S-OASIS and S Angthong Industrial Estate. These business segments also maintain a balanced income profile, driven by recurring revenue from the strong operational performance of Singha Estate’s three primary office buildings: Singha Complex, Sun Towers, and S Metro. The company additionally sees stable revenue streams from power plant profit-sharing arrangements as well as utility sales and service fees from the industrial estate business.

“Beyond our commitment to business management, Singha Estate has reinforced cash flow stability through diversified funding sources including successful debenture issuances over the past three years with plans for continued offerings. Moreover, the acquisition of a Green Loan from banking institutions for the S-OASIS—an office building designed to balance aesthetic appeal with environmental stewardship—is not just an affirmation of bank confidence in our company, and it also underscores our business approach of meticulously developing projects to create sustainable value and drive growth. We prioritize stakeholder engagement while maintaining an equal balance between social, environmental, and communities”, added Thitima.

Share :